Organizations →

→

- 23 Apr 2024

- In Practice

Getting to Net Zero: The Climate Standards and Ecosystem the World Needs Now

What can companies and regulators do as climate predictions grow grimmer? They should measure impact, strengthen environmental institutions, and look to cities to lead, say Robert Kaplan, Shirley Lu, and Rosabeth Moss Kanter.

- 22 Apr 2024

- Research & Ideas

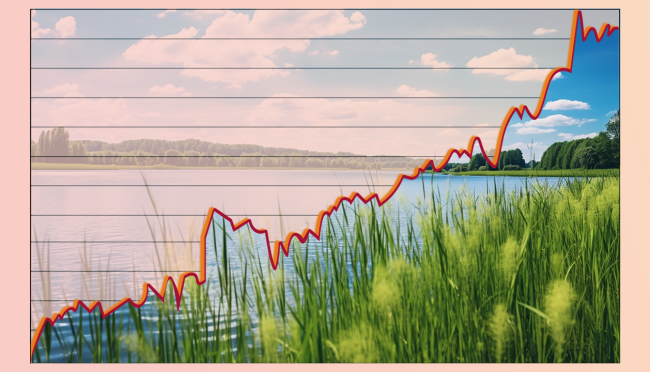

When Does Impact Investing Make the Biggest Impact?

More investors want to back businesses that contribute to social change, but are impact funds the only approach? Research by Shawn Cole, Leslie Jeng, Josh Lerner, Natalia Rigol, and Benjamin Roth challenges long-held assumptions about impact investing and reveals where such funds make the biggest difference.

- 09 Apr 2024

- Book

Why Work Rituals Bring Teams Together and Create More Meaning

From weekly lunch dates with colleagues to bedtime stories with children, we often rely on rituals to relax and bond with others. While it may feel awkward to introduce teambuilding rituals in the workplace, the truth is, the practices improve performance, says Michael Norton in his book The Ritual Effect.

- 18 Mar 2024

- Research & Ideas

When It Comes to Climate Regulation, Energy Companies Take a More Nuanced View

Many assume that major oil and gas companies adamantly oppose climate-friendly regulation, but that's not true. A study of 30 years of corporate advocacy by Jonas Meckling finds that energy companies have backed clean-energy efforts when it aligns with their business interests.

- 12 Mar 2024

- HBS Case

How Used Products Can Unlock New Markets: Lessons from Apple's Refurbished iPhones

The idea of reselling old smartphones might have seemed risky for a company known for high-end devices, but refurbished products have become a major profit stream for Apple and an environmental victory. George Serafeim examines Apple's circular model in a case study, and offers insights for other industries.

- 16 Feb 2024

- Research & Ideas

Is Your Workplace Biased Against Introverts?

Extroverts are more likely to express their passion outwardly, giving them a leg up when it comes to raises and promotions, according to research by Jon Jachimowicz. Introverts are just as motivated and excited about their work, but show it differently. How can managers challenge their assumptions?

- 05 Feb 2024

- Research & Ideas

The Middle Manager of the Future: More Coaching, Less Commanding

Skilled middle managers foster collaboration, inspire employees, and link important functions at companies. An analysis of more than 35 million job postings by Letian Zhang paints a counterintuitive picture of today's midlevel manager. Could these roles provide an innovation edge?

- 17 Jan 2024

- Research & Ideas

Are Companies Getting Away with 'Cheap Talk' on Climate Goals?

Many companies set emissions targets with great fanfare—and never meet them, says research by Shirley Lu and colleagues. But what if investors held businesses accountable for achieving their climate plans?

- 09 Jan 2024

- Research & Ideas

Could Clean Hydrogen Become Affordable at Scale by 2030?

The cost to produce hydrogen could approach the $1-per-kilogram target set by US regulators by 2030, helping this cleaner energy source compete with fossil fuels, says research by Gunther Glenk and colleagues. But planned global investments in hydrogen production would need to come to fruition to reach full potential.

- 02 Jan 2024

- Cold Call Podcast

Should Businesses Take a Stand on Societal Issues?

Should businesses take a stand for or against particular societal issues? And how should leaders determine when and how to engage on these sensitive matters? Harvard Business School Senior Lecturer Hubert Joly, who led the electronics retailer Best Buy for almost a decade, discusses examples of corporate leaders who had to determine whether and how to engage with humanitarian crises, geopolitical conflict, racial justice, climate change, and more in the case, “Deciding When to Engage on Societal Issues.”

- 02 Jan 2024

- Research & Ideas

10 Trends to Watch in 2024

Employees may seek new approaches to balance, even as leaders consider whether to bring more teams back to offices or make hybrid work even more flexible. These are just a few trends that Harvard Business School faculty members will be following during a year when staffing, climate, and inclusion will likely remain top of mind.

- 12 Dec 2023

- Cold Call Podcast

Can Sustainability Drive Innovation at Ferrari?

When Ferrari, the Italian luxury sports car manufacturer, committed to achieving carbon neutrality and to electrifying a large part of its car fleet, investors and employees applauded the new strategy. But among the company’s suppliers, the reaction was mixed. Many were nervous about how this shift would affect their bottom lines. Professor Raffaella Sadun and Ferrari CEO Benedetto Vigna discuss how Ferrari collaborated with suppliers to work toward achieving the company’s goal. They also explore how sustainability can be a catalyst for innovation in the case, “Ferrari: Shifting to Carbon Neutrality.” This episode was recorded live December 4, 2023 in front of a remote studio audience in the Live Online Classroom at Harvard Business School.

- 05 Dec 2023

- Cold Call Podcast

Tommy Hilfiger’s Adaptive Clothing Line: Making Fashion Inclusive

In 2017, Tommy Hilfiger launched its adaptive fashion line to provide fashion apparel that aims to make dressing easier. By 2020, it was still a relatively unknown line in the U.S. and the Tommy Hilfiger team was continuing to learn more about how to serve these new customers. Should the team make adaptive clothing available beyond the U.S., or is a global expansion premature? Assistant Professor Elizabeth Keenan discusses the opportunities and challenges that accompanied the introduction of a new product line that effectively serves an entirely new customer while simultaneously starting a movement to provide fashion for all in the case, “Tommy Hilfiger Adaptive: Fashion for All.”

- 21 Nov 2023

- Cold Call Podcast

Cold Call: Building a More Equitable Culture at Delta Air Lines

In December 2020 Delta Air Lines CEO Ed Bastian and his leadership team were reviewing the decision to join the OneTen coalition, where he and 36 other CEOs committed to recruiting, hiring, training, and advancing one million Black Americans over the next ten years into family-sustaining jobs. But, how do you ensure everyone has equal access to opportunity within an organization? Professor Linda Hill discusses Delta’s decision and its progress in embedding a culture of diversity, equity, and inclusion in her case, “OneTen at Delta Air Lines: Catalyzing Family-Sustaining Careers for Black Talent.”

- 21 Nov 2023

- Op-Ed

The Beauty Industry: Products for a Healthy Glow or a Compact for Harm?

Many cosmetics and skincare companies present an image of social consciousness and transformative potential, while profiting from insecurity and excluding broad swaths of people. Geoffrey Jones examines the unsightly reality of the beauty industry.

- 31 Oct 2023

- Research & Ideas

Beyond the 'Business Case' in DEI: 6 Steps Toward Meaningful Change

Diversity and inclusion efforts that focus on business outcomes alone rarely address root causes. Jamillah Bowman Williams, a visiting fellow at the Institute for the Study of Business in Global Society, offers tips for companies navigating their next stage of the DEI journey.

- 24 Oct 2023

- Cold Call Podcast

How the United States Air Force Accelerated AI Adoption

In August 2022, the Pentagon tasked U.S. Air Force Captain Victor Lopez with launching a new Air Force innovation unit that leveraged commercial developers and military talent to acquire advanced technologies. Having been granted flexibility in the setup of the office, Lopez pondered the complexities of his assignment and the decisions around organizational design he would have to make. It’s often believed that only small start-up organizations can innovate, but a lot of innovation happens in big organizations, including government. Harvard Business School assistant professor Maria Roche is joined by Major Lopez to discuss the challenges of digital transformation in a large bureaucratic organization and the specific choices the U.S. Air Force needed to make when launching its AI Accelerator in her case, "Accelerating AI Adoption in the United States Air Force."

- 16 Oct 2023

- HBS Case

Advancing Black Talent: From the Flight Ramp to 'Family-Sustaining' Careers at Delta

By emphasizing skills and expanding professional development opportunities, the airline is making strides toward recruiting and advancing Black employees. Case studies by Linda Hill offer an inside look at how Delta CEO Ed Bastian is creating a more equitable company and a stronger talent pipeline.

- 06 Oct 2023

- Book

Yes, You Can Radically Change Your Organization in One Week

Skip the committees and the multi-year roadmap. With the right conditions, leaders can confront even complex organizational problems in one week. Frances Frei and Anne Morriss explain how in their book Move Fast and Fix Things.

Amazon in Seattle: The Role of Business in Causing and Solving a Housing Crisis

In 2020, Amazon partnered with a nonprofit called Mary’s Place and used some of its own resources to build a shelter for women and families experiencing homelessness on its campus in Seattle. Yet critics argued that Amazon’s apparent charity was misplaced and that the company was actually making the problem worse. Paul Healy and Debora Spar explore the role business plays in addressing unhoused communities in the case “Hitting Home: Amazon and Mary’s Place.”